when will capital gains tax increase uk

Three times as many people will have to pay capital gains tax under plans to pay for the cost of the pandemic put. CAPITAL GAINS TAX is Chancellor Rishi Sunaks top tax target in his upcoming Autumn Budget experts warn.

Difference Between Income Tax And Capital Gains Tax Difference Between

Youll only need to pay these rates.

. OTS proposes higher rates of CGT. UK company bosses and senior executives are preparing to sell down stakes in businesses ahead of a potential increase in capital gains tax next year. However if the house sold has made a bigger profit than the basic rate band then the seller could have to pay Capital Gains Tax at 28.

10 and 20 tax rates for individuals not including residential property and carried interest. Ad Get Support And Advice From The UKs Leading Independent Holiday Letting Agency. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax.

In a letter to the Officer of Tax Simplification conservative MP Lucy Frazer on behalf of the Treasury said. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four. Browse discover thousands of brands.

The CGT allowance has been increased to 12300 and the time to pay CGT on property sales will be cut to 30 days from the date of sale from 6 April. If a persons taxable. Chancellor Rishi Sunak swerved making any major changes to the tax people pay when they sell assets such as a second home or shares.

Most capital gains tax comes from a small number of taxpayers who make large gains. Legislation will be introduced in Finance Bill 2016 to amend subsections 4 2 3 4 and 5 of TCGA to reduce the 18 and 28. Similarly to the National Insurance rate rises those who earn money from dividends will also see a.

The prices of houses in the UK increased by 98 in 2021 which means more Capital Gains Tax for. In his autumn Budget. By Katey Pigden 27th October 2021 347 pm.

By Harry Brennan 11 November 2020 136pm. With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey. The 3tn windfall from soaring house prices in the past 20 years should be subject to a capital gains levy so that poorer households can.

Capital Gains Tax is a confusing subject for many but the general rule is that Britons have a tax-free allowance which currently stands at 12300 or 6150 for trusts. Class 3 1585 per week. Any gain over that amount is taxed at what appears to be particularly favourable rates with basic rate taxpayers paying tax at 10 or 18 on residential property and high or higher rate taxpayers only incurring.

Dividend tax rates to increase. 18 and 28 tax rates for. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more.

Capital gains tax rates for 2022-23 and 2021-22. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due. This means that the rate you pay depends on the size of the gain and not whether you are a basic rate taxpayer.

Find out moreNational Insurances rates. By Charlie Bradley 0700 Thu Oct 28 2021 UPDATED. The average CGT bill is already 32000 and the tax rate could more than DOUBLE.

20 for companies non-resident Capital Gains Tax on the disposal of a UK residential. Gains from selling other assets are charged at 10 for basic-rate taxpayers and 20 for higher-rate taxpayers. In 2019-20 41 percent of capital gains tax came from those who made gains of 5million or more - a group which.

Chancellor Rishi Sunak has announced the government will slightly increase the capital gains tax CGT allowance and significantly reduce entrepreneurs relief in todays Budget. The following Capital Gains Tax rates apply. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. A review commissioned by Rishi Sunak the. Read customer reviews find best sellers.

Exclusive analysis of 540000 wealthiest individuals in the UK shows effects of low capital gains tax Why capital gains tax reform should be top of Rishi Sunaks list The maximum UK tax rate for. Capital gains tax is charged at 10 per cent for basic rate taxpayers and 20 per cent for higher and additional rate taxpayers with rates. The capital gains tax allowance remains at 12300 the same as for 2021 to 2022.

The government has shelved proposals to raise capital gains tax but has agreed to make technical tweaks to simplify the process. If the asset is jointly owned with another person its. As you rightly highlight in your first report these reforms would involve a number.

How Capital Gains Affect Your Taxes H R Block

How Much Tax Will I Pay If I Flip A House New Silver

Capital Gains Yield Cgy Formula Calculation Example And Guide

Difference Between Income Tax And Capital Gains Tax Difference Between

Capital Gains Tax What Is It When Do You Pay It

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

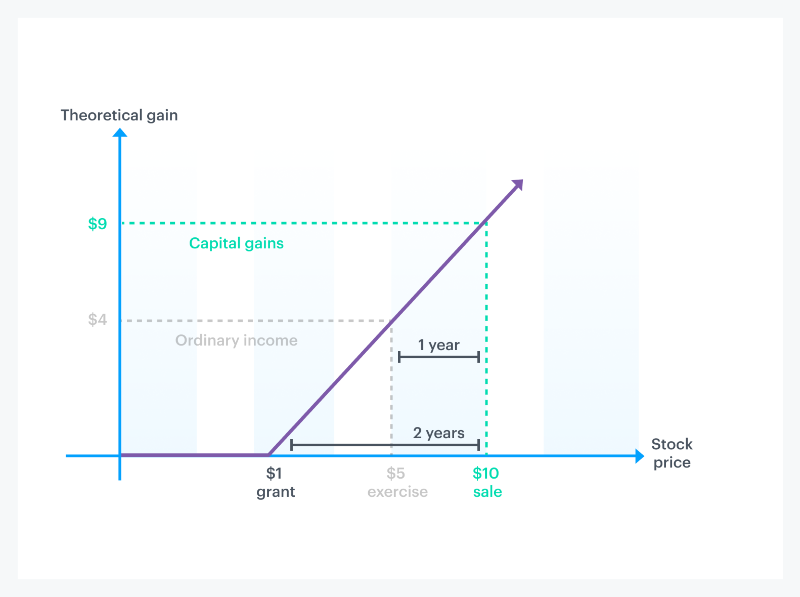

How Stock Options Are Taxed Carta

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

How Do Taxes Affect Income Inequality Tax Policy Center

What Are Capital Gains Tax Rates In Uk Taxscouts

How Stock Options Are Taxed Carta

Capital Gains Tax What Is It When Do You Pay It

How Are Dividends Taxed Overview 2021 Tax Rates Examples

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

U K Treasury Told To Avoid Tax Increases As Budget Deficit Growsby Alex Morales David Goodman And Andrew Capital Gains Tax Advanced Economy Government Debt

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Canada Capital Gains Tax Calculator 2022