indiana tax payment plan

Find Indiana tax forms. Indiana State Tax Installment Plan.

Indiana House Republicans Want To Slash The Income Tax

If you have an account or would like to create one or if you.

. Know when I will receive my tax refund. The DOR will allow taxpayers to set up a monthly tax payment plan to pay their tax liability over time. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. To request a payment plan after you receive a bill go online to the Department of Revenues Intax Pay portal or call 1-317-232-2165. Know when I will receive my tax refund.

If you have a stable job then you should be able to speak with the IRS or Indiana Department of Revenue about a State of Indiana tax payment plan. Many taxpayers have enough taxes withheld from their income throughout the year to cover their year-end total tax. Failed amendments included a disbursement of 1 billion to Indiana.

Find Indiana tax forms. The Indiana income tax system is a pay-as-you-go system. Pay a bill through INTIME.

While a federal or Indiana tax payment plan can be a good option to pay your tax debt a thorough evaluation by an Indiana tax lawyer will help ensure you choose the best method for resolving. However the DOR requires that taxpayers have a balance greater than. Indianas DOR will still impose a 10 penalty on outstanding balance for the duration of the payment.

DOR offers several payment plan options for individual income tax customers who owe more than 100 and business tax customers who owe more than 500. With Department of Revenue approval you can also set up a tax payment plan or file a payment under a deadline extension through the ePay system. Hoosiers wishing to take advantage of this option can find out if they are eligible by.

Check status of payment. Pay Your Property Taxes. An Indiana income tax payment plan will.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Pay by check or money order. Pay your Indiana tax return.

Once a tax return has been. If the taxpayer cannot make minimum monthly payments with a tax payment plan he or she may want to look at Indianas Hardship Program an Offer in Compromise. Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA.

What if I cant fully pay my back Indiana taxes or even afford the payment plans offered by the Indiana Department of Revenue my Indiana Countys Sheriff Department or United Collection. Many taxpayers have enough taxes withheld from their income throughout the year to cover their year-end total tax. If youre sending a tax payment.

If you have questions about paying your Indiana income tax contact the Department of Revenues hotline at 317 232-2240. The Indiana income tax system is a pay-as-you-go system. Hotelluxe1234 February 27 2022.

Indiana Department of Revenue. There are -921 days left until Tax Day on April 16th 2020. Make a payment plan payment.

Payment plans can be set from 3 to 36-month increments depending on the amount of the tax bill. Where things stand with Indiana Automatic Taxpayer Refund proposed second round of payments.

Dor Need A Payment Plan Set It Up In Intime

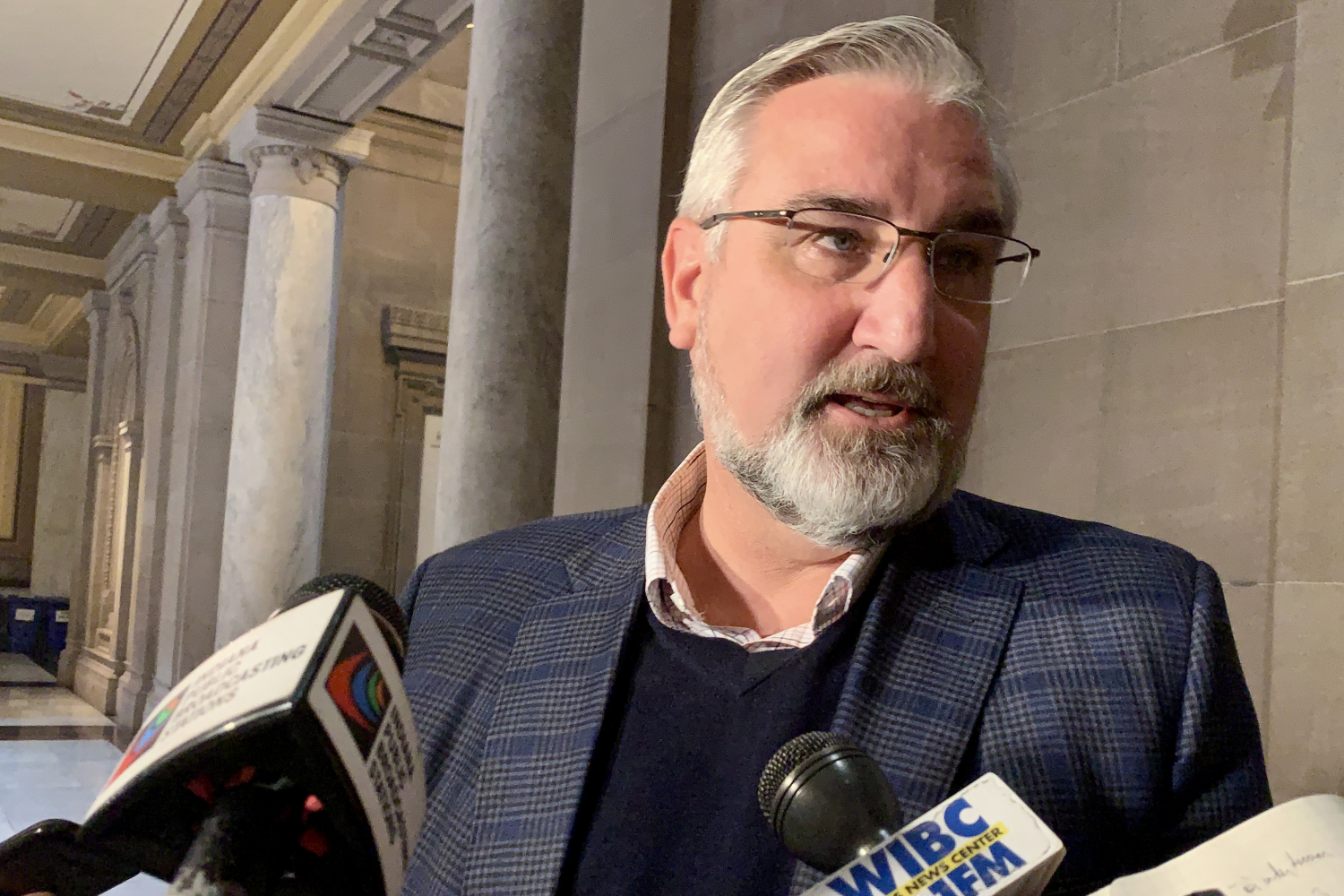

Indiana Governor Signs Gradual Income Tax Cut Plan Into Law

2022 State Tax Reform State Tax Relief Rebate Checks

Free Payment Plan Agreement Template Word Pdf Eforms

/cloudfront-us-east-1.images.arcpublishing.com/gray/EX63JD7JMZHZBE7XZOZLOEHYXU.jpg)

Indiana Lawmakers Approve Multiyear Income Tax Cut Plan

/cloudfront-us-east-1.images.arcpublishing.com/gray/WYQRSDK76RG45EIBX47AU6TIQM.jpg)

Indiana Tax Cut Plan Hits Wall With State Senate Opposition

State Plans On Making You Pay Online Sales Tax Wish Tv Indianapolis News Indiana Weather Indiana Traffic

Irs And Tax Resolution Services Indianapolis Irs And Indiana Tax Matters Ontarget Cpa

An Indiana Tax Lawyer Explains Irs Installment Plans State Payment Options Camden Meridew P C

Nearly 4 3 Million People In Indiana To Receive Payments Up To 250 Starting This Month Polarbear Newsbreak Original

Indiana Tax Cut Proposal S Prospects Dim At Statehouse

![]()

Dor Indiana Department Of Revenue

As Indiana Considers Second Tax Refund Some Wonder Where S The First Inside Indiana Business

Free Payment Plan Agreement Template Word Pdf Eforms

Instructions For Form 9465 10 2020 Internal Revenue Service

Dor Need A Payment Plan Set It Up In Intime

Indiana Tax Cut Plan Hits Wall With Senate Opposition Inside Indiana Business